As the summer of 2024 approaches, the question on many prospective homebuyers’ minds is clear: when will the housing market crash again? This looming uncertainty has created a palpable sense of anxiety, especially for those eager to take the plunge into homeownership. But fear not, my friends — armed with the right insights and strategies, you can navigate these turbulent waters and make an informed decision that aligns with your financial goals.

Let’s start by understanding the root of this concern. The housing market has been a rollercoaster ride in recent years, with the scars of the Great Recession still fresh in our memories. We’ve witnessed the devastating impact a housing market crash can have — plummeting home values, foreclosures, and a ripple effect that reverberates through the entire economy. It’s no wonder that the specter of another such event haunts the dreams of potential homebuyers.

But here’s the thing: while we can’t predict the future with absolute certainty, we can analyze the current landscape and identify the key factors that could influence the housing market in the coming years. By understanding the signs of a potential slowdown and arming ourselves with practical tips, we can make informed decisions and position ourselves for success, regardless of what the market has in store.

Navigating the Uncertainty: Factors Shaping the Housing Market

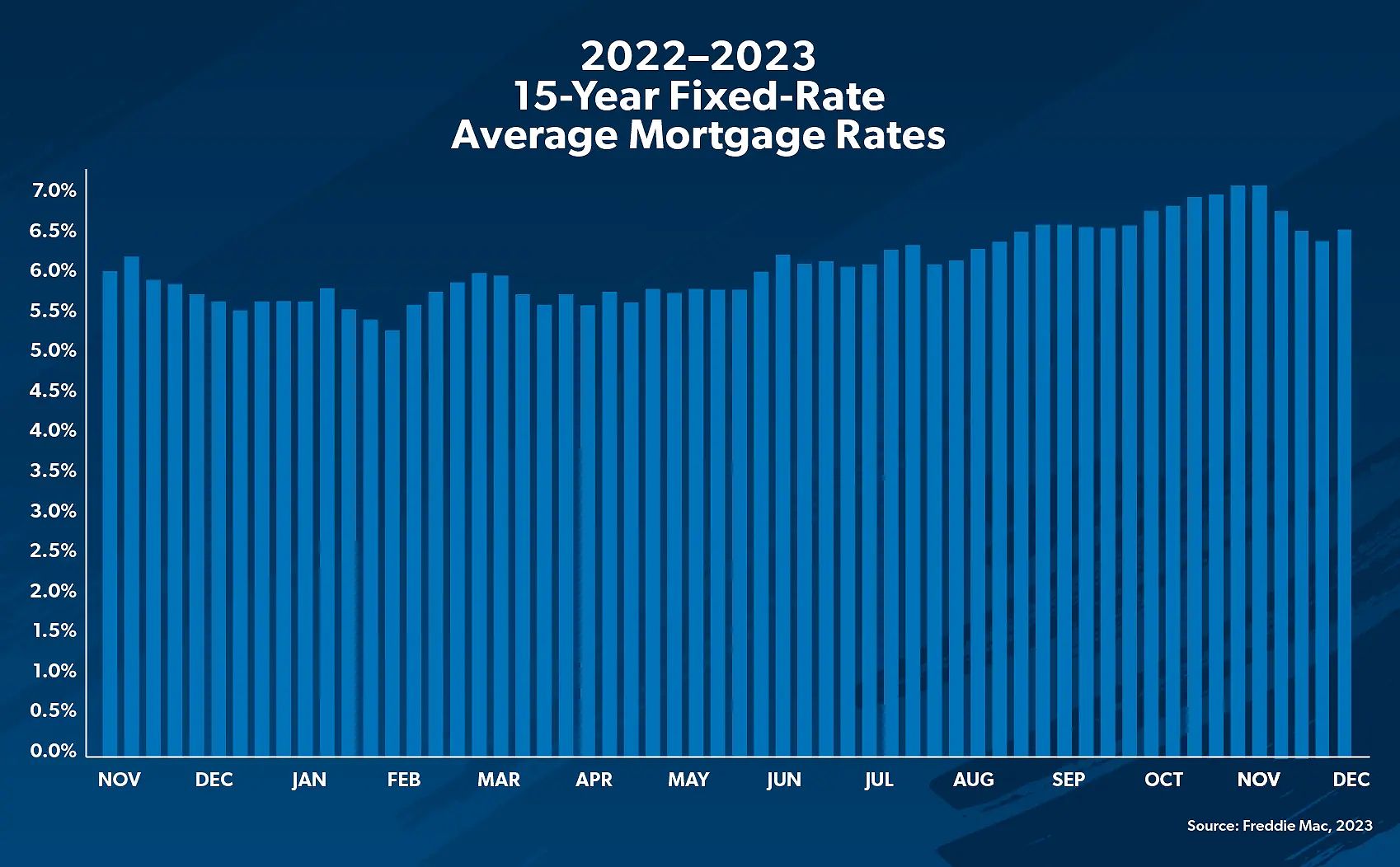

When it comes to the housing market, there are a few crucial elements that demand our attention. First and foremost, the rise in interest rates is a significant concern. As the Federal Reserve continues to hike rates in an effort to tame inflation, borrowing costs for mortgages have been steadily climbing. This makes it more expensive for prospective buyers to finance their dream homes, potentially dampening demand and putting downward pressure on prices.

Inflation, the persistent thorn in the side of consumers, is another factor that can’t be ignored. As the cost of living continues to soar, buyers’ purchasing power is eroded, making it increasingly challenging to afford a home. This economic pressure can lead to a decline in housing demand, further exacerbating the situation.

And let’s not forget the looming specter of a recession. Economic downturns often bring with them job losses and decreased consumer confidence, both of which can have a devastating impact on the housing market. If people feel uncertain about their financial futures, they’re less likely to make major investments, such as purchasing a home.

Signs of a Potential Housing Market Slowdown

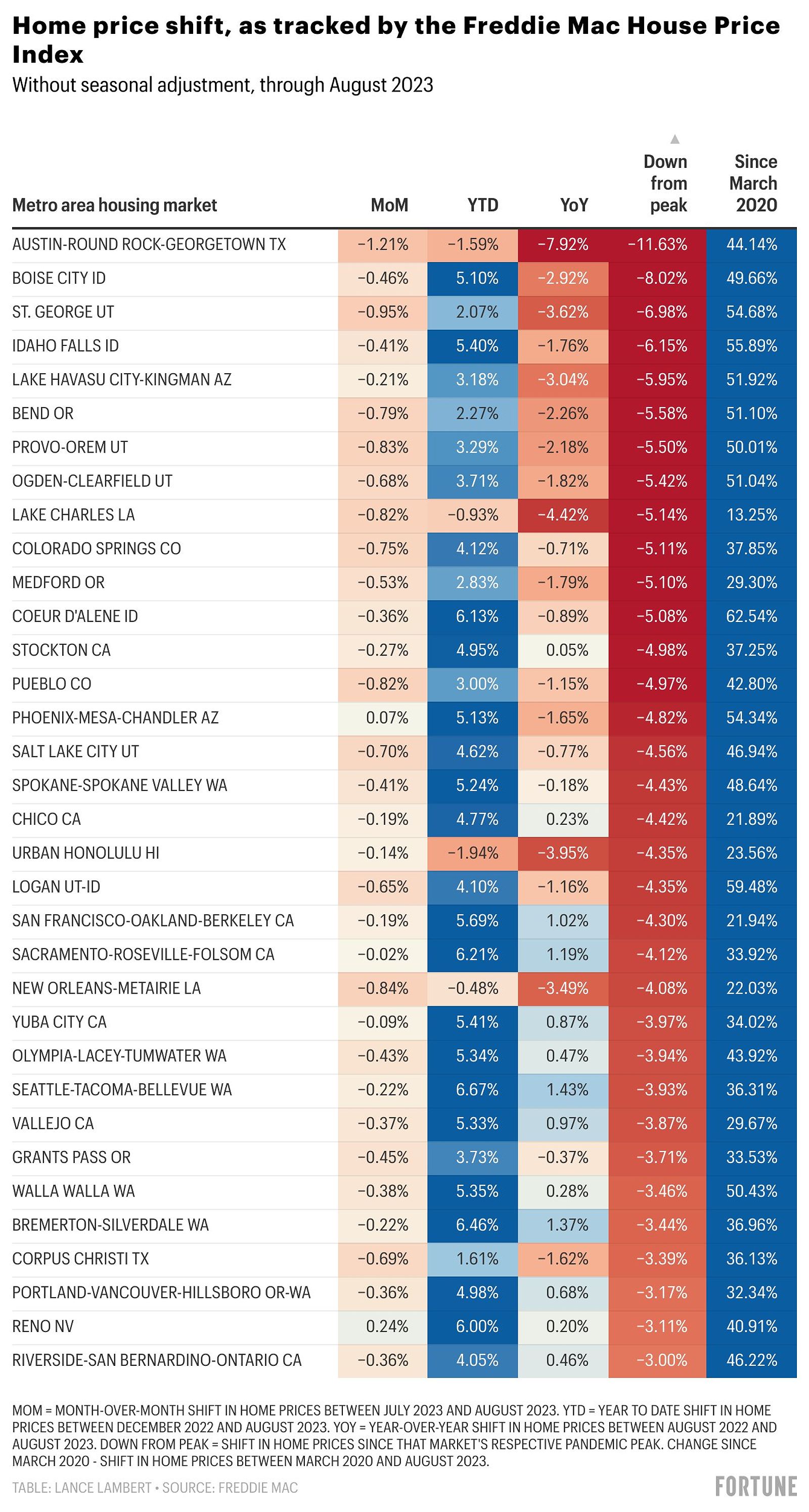

While a full-blown housing market crash may not be imminent, there are several indicators that suggest the market is starting to cool. One of the most notable is the deceleration of home price growth. In many regions, the breakneck pace of price appreciation has slowed, and some markets are even witnessing modest declines.

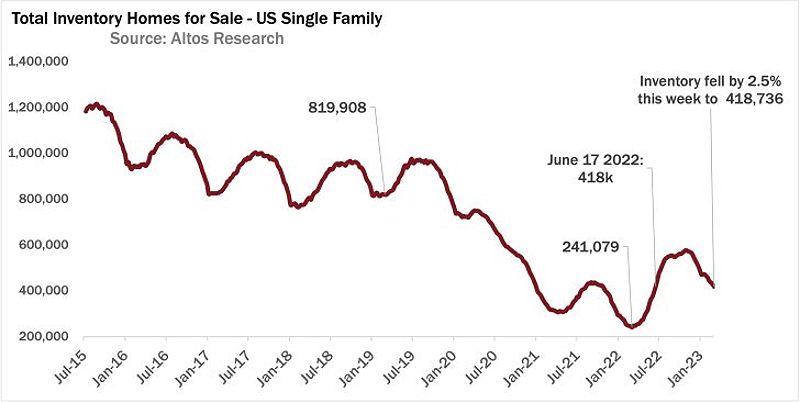

Another sign to watch for is an increase in housing inventory. As more homes become available for sale, buyers may have more options, leading to increased competition and potentially lower prices. This uptick in inventory can be a signal that sellers are adjusting their expectations in response to shifting market dynamics.

Equally important is the cooling of demand. Many potential buyers are holding off on making purchases due to concerns about affordability and the rising cost of homeownership. As mortgage rates continue to climb, the dream of homeownership becomes increasingly elusive for some, leading to a slowdown in market activity.

Navigating the Market: Strategies for Potential Homebuyers

So, what should you do if you’re a potential homebuyer in 2024? Here are some practical strategies to help you navigate the uncertain waters:

-

Get Pre-Approved for a Mortgage: Before you even start your home search, it’s crucial to get pre-approved for a mortgage. This will not only give you a clear understanding of your budget but also demonstrate to sellers that you’re a serious and financially capable buyer.

-

Crunch the Numbers: Don’t just focus on the sticker price of a home — take a deep dive into your finances and be realistic about what you can truly afford. Factor in not only the mortgage payments but also ongoing expenses like property taxes, insurance, and maintenance.

-

Shop Around for Lenders: Interest rates can vary significantly between lenders, so don’t just settle for the first offer you receive. Invest the time to compare rates, fees, and terms from multiple financial institutions to ensure you’re getting the best deal possible.

-

Patience is a Virtue: In a slowing market, it’s essential to take your time and not rush into a purchase. Carefully research neighborhoods, study market trends, and be prepared to negotiate. Remember, the right home is worth waiting for.

-

Explore Alternative Options: If the prospect of buying a home in the current market fills you with trepidation, consider renting for the time being. This can provide you with the flexibility to reevaluate your options as the market evolves.

-

Stay Informed: Keep a close eye on housing market news and economic indicators. Understanding the broader trends will empower you to make informed decisions that align with your long-term financial goals.

What to Do if When Will Housing Market Crash Again Becomes a Reality

While a full-blown housing market crash may not be imminent, it’s wise to have a contingency plan in place. If the unthinkable were to occur, here’s what you can do:

-

Remain Calm: It’s natural to feel anxious, but it’s crucial to maintain a level head. Panic can lead to hasty decisions that may not be in your best interests.

-

Assess Your Finances: Carefully review your financial situation and ensure that you can still comfortably afford your mortgage payments, even if home values decline. Prioritize your emergency savings and explore options like refinancing.

-

Seek Professional Guidance: Don’t hesitate to reach out to financial advisors or real estate experts for personalized advice. They can help you navigate the complexities of the housing market and explore the best course of action for your specific circumstances.

FAQ

Q: What are the clear signs that a housing market crash is imminent?

A: Keep an eye out for a sharp decline in home prices, a significant increase in housing inventory, a decrease in mortgage applications, and a rise in foreclosures. These can all be early indicators of a potential market downturn.

Q: If a crash happens, will my home lose value?

A: It’s possible, but the extent of the decline will depend on the severity of the crash and the specific conditions in your local market. Every situation is unique, so it’s crucial to closely monitor the trends in your area.

Q: Should I wait to buy a house if a crash is possible?

A: There’s no one-size-fits-all answer to this question. If you’re financially prepared and can afford to wait, it might be a prudent decision. However, there’s no guarantee that prices will drop significantly, so it ultimately comes down to your personal circumstances and risk tolerance.

Conclusion: Navigating the Uncertain Waters

As we navigate the ever-evolving housing market landscape, the question “when will the housing market crash again?” is undoubtedly on the minds of countless potential homebuyers. While we can’t predict the future with certainty, understanding the key factors at play and staying vigilant can help you make informed decisions that align with your financial goals.

Whether you choose to buy now or wait it out, remember that the right time to take the plunge is when you feel financially ready and confident in your ability to weather any storms that may come. With the right strategies and a solid plan in place, you can confidently navigate the housing market in 2024 and beyond.

So, take a deep breath, do your research, and trust your instincts. The path to homeownership may not be a straight line, but with the right mindset and preparation, you can turn the housing market’s uncertainties into your own personal triumph. With the right guidance and a bit of courage, the dream of homeownership is within reach, even in these uncertain times.