Is The Housing Market Slowing Down In 2024?

Is the housing market slowing down in 2024? This question is on the minds of many potential homebuyers as the market continues to evolve. While there are certainly signs of a slowdown, the overall outlook remains uncertain, with a complex interplay of factors shaping the market’s trajectory.

Is the Housing Market Slowing Down? Identifying Signs of a Slowing Housing Market

One of the most telling indicators of a slowing market is the drop in home sales. The National Association of Realtors has reported a 5% decrease in existing home sales over the past year, while new home sales have also dipped by around 7%. This decline, however, is not uniform across the country. Certain markets, like Spokane-Spokane Valley, WA, are facing a higher risk of home price drops, while others, such as Palm Bay-Melbourne-Titusville, FL, and Salt Lake City, UT, are showing potential signs of a downward trend.

Another key sign of a slowing market is the increase in housing inventory. After years of tight supply, we’re finally seeing more options for buyers, which could be a game-changer in a competitive market. This shift means potential homebuyers might have a bit more negotiating power, but it also raises questions about how this increase in supply will impact home prices.

Rising Interest Rates and Their Impact on Affordability

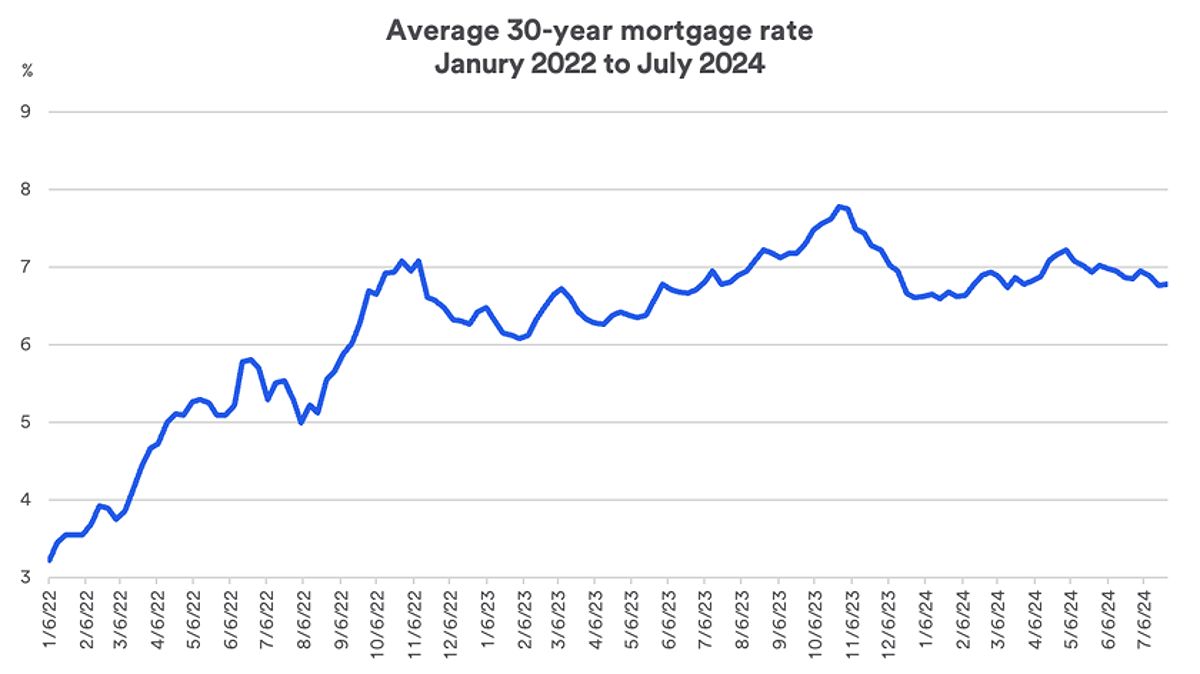

As of August 2024, the average 30-year mortgage rate has skyrocketed to around 7%, a far cry from the sub-3% levels we saw just a few years ago. This surge in rates has had a significant impact on affordability, making it increasingly challenging for potential homebuyers to secure financing and make that dream purchase.

A small uptick in interest rates can lead to hundreds of dollars in additional monthly payments, enough to make even the most determined buyer pause and reconsider their options. Consequently, many potential buyers are left with a tough decision: do they press on and navigate the shifting market, or do they wait it out and hope for more favorable financial conditions?

Navigating Uncertainty in the Housing Market

As the housing market continues to evolve, it’s understandable for potential homebuyers to feel a bit overwhelmed. The key is to approach this situation with a clear head and a solid plan.

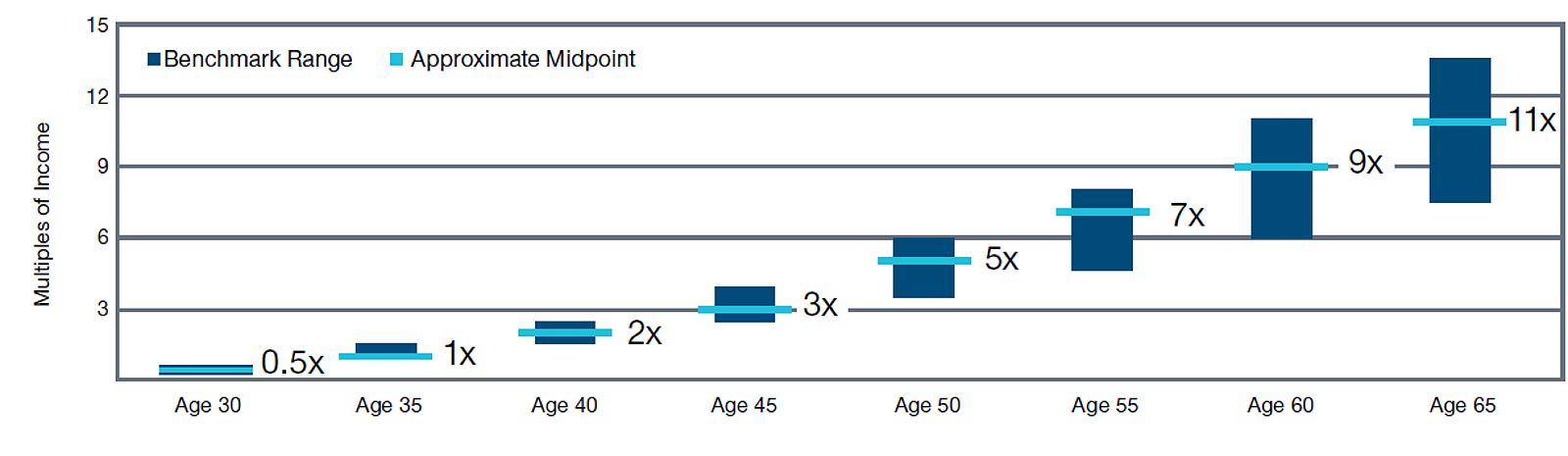

First, take a close look at your financial situation. Are you ready to take the plunge, or is it wiser to adopt a wait-and-see approach? Consider factors like job stability, savings, and credit scores, as they’ll play a significant role in determining whether you can secure favorable mortgage terms.

If you’re feeling confident and have a long-term outlook, now might still be a suitable time to start your home-buying journey. But if you’re uncertain about your financial footing or the market’s future, it’s perfectly okay to hit the pause button. Monitor the market closely, stay informed about interest rate forecasts, and regularly evaluate your personal circumstances. This proactive approach will empower you to make the best decision for your unique situation.

Finding Opportunities in a Slowing Housing Market

As the competition heats up, potential homebuyers might have more opportunities to negotiate and secure favorable terms. The key is to arm yourself with knowledge — research the local market, stay up-to-date on recent sales, and understand price trends. Collaborating with a knowledgeable real estate agent can also be invaluable, as they can guide you through the negotiation process and help you identify properties that are reasonably priced.

Don’t be afraid to attend open houses and explore various neighborhoods to gain a better understanding of the market. This firsthand experience can give you a competitive edge and help you identify potential gems. And remember, being patient and willing to walk away from deals that don’t meet your criteria can empower you during those all-important negotiations.

The Future of the Housing Market: Key Factors to Watch

The housing market’s trajectory will be shaped by a complex interplay of factors, from economic conditions to government policies and demographic shifts. Experts and financial institutions have varying perspectives on the future, with some forecasting a continued moderation in home price growth, while others anticipate more substantial declines in specific regions.

One factor to watch closely is the impact of economic conditions, such as employment levels and consumer confidence, on the housing market. A strong labor market can bolster buyer confidence and encourage more people to enter the market, while a weakening economy could lead to a decline in housing demand.

Government policies and regulations also play a crucial role in shaping the housing market. For example, changes in zoning laws or incentives for first-time homebuyers can influence market dynamics. Additionally, the availability of new construction will continue to affect supply levels, as builders respond to changing demand patterns.

Demographic trends are another important consideration. Younger generations, particularly millennials, are increasingly becoming a driving force in the housing market. Their preferences and financial capabilities will shape future housing demand, making it essential to understand their needs and aspirations as potential buyers.

Housing Market Predictions: What Experts Say

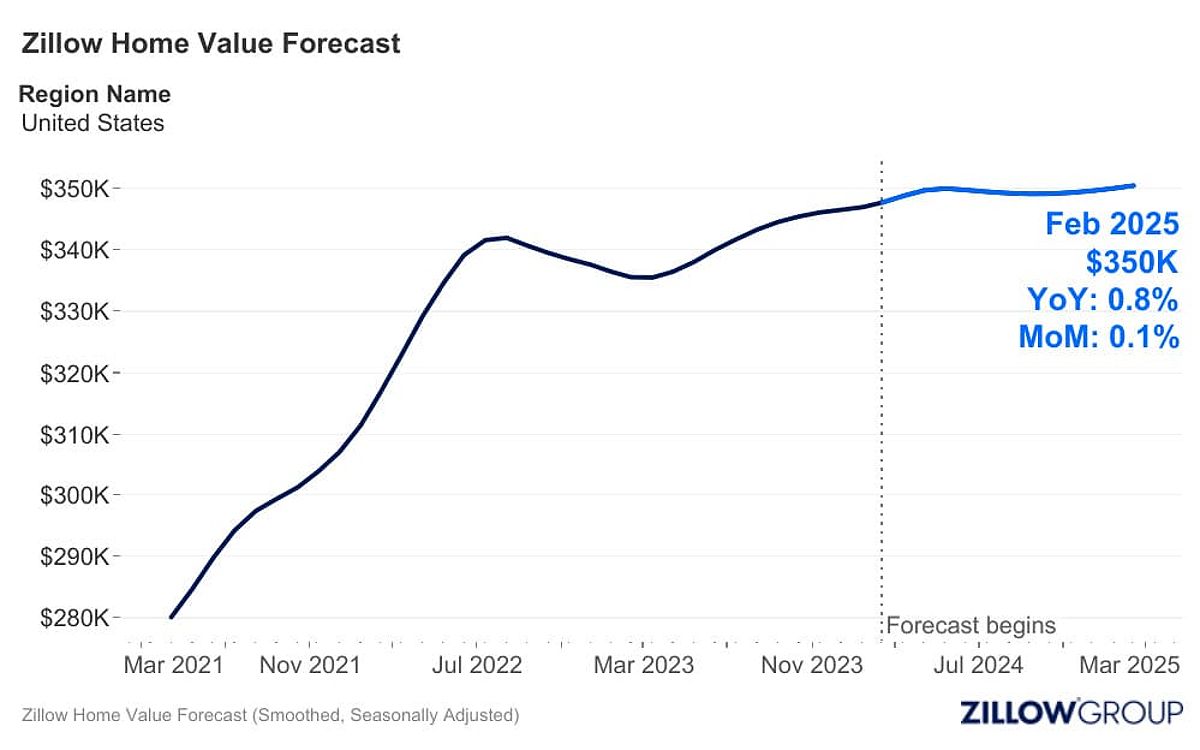

Experts and financial institutions have varying perspectives on the future of the housing market. Some forecasts suggest a continued moderation in home price growth, while others anticipate more substantial declines in specific regions.

For instance, some analysts believe that the housing market will continue to cool, with a gradual decline in home prices as the year progresses. However, other experts foresee a more significant correction in certain overheated markets, where prices may drop more dramatically.

Regardless of the specific predictions, one thing is clear: the housing market is cyclical. While current conditions may present challenges, history has shown that markets can rebound. By staying informed, monitoring market trends, and understanding your personal goals, you’ll be better equipped to make the best decision for your homeownership dreams.

The Impact of Inflation on the Housing Market

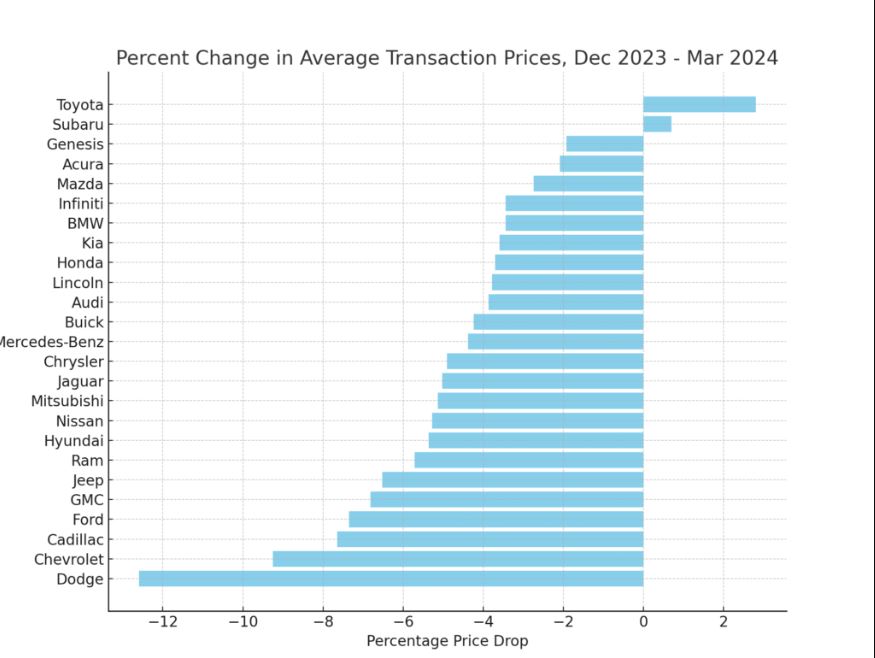

As if the rising interest rates weren’t enough, the housing market is also grappling with the effects of high inflation. Prices for construction materials, labor, and other related expenses have soared, putting additional pressure on builders and developers. This, in turn, has led to higher home prices, further straining affordability for potential buyers.

The impact of inflation extends beyond just the cost of the home itself. Everyday expenses like groceries, utilities, and transportation have also become more expensive, leaving less room in household budgets for mortgage payments. This squeeze on disposable income can deter some buyers from entering the market, as they prioritize other essential spending.

Monitoring the interplay between interest rates, home prices, and inflation will be crucial for homebuyers navigating the 2024 market. Staying vigilant and adapting to the changing conditions will be key to finding the right balance between affordability and fulfilling the dream of homeownership.

Frequently Asked Questions

Q: Is the housing market going to crash?

A: While there are concerns about a potential housing market crash, experts don’t anticipate a downturn on the scale of the Great Recession. Certain regions may experience declines, but overall, the market is expected to stabilize and return to more typical housing fundamentals.

Q: How long will interest rates stay high?

A: The future trajectory of interest rates is uncertain, influenced by various economic factors and Federal Reserve policies. Many analysts expect mortgage rates to remain elevated in the near term, with potential gradual declines as the year progresses.

Q: What is a good interest rate for a mortgage?

A: A “good” mortgage rate varies based on your personal financial situation and current market conditions. Generally, an interest rate below 7% is considered favorable in today’s environment, but it’s crucial to evaluate your budget and long-term goals to determine what works best for you.

Q: Should I wait for prices to drop before buying?

A: The decision to wait for potential price drops or to buy a home now depends on your individual circumstances and market expectations. If you’re financially ready and have a long-term outlook, purchasing a home may still be a viable option, even in a slowing market.

Conclusion

The housing market is in a state of flux, with a complex interplay of factors influencing its trajectory. While signs of a slowdown are evident, the future remains uncertain. By staying informed and adapting to market changes, potential homebuyers can make informed decisions that align with their long-term goals. Whether you choose to buy now or wait for further adjustments, the key is to approach the housing market with a clear understanding of your financial situation and a strategic plan.

MORE FROM searchsmartdeals.com