Unlock The Door To Your Washington Dream Home: A Strategic Guide For First-time Buyers In 2024

Homeownership, a coveted dream for many, can feel like an elusive pursuit, especially for first-time buyers navigating the dynamic Washington housing market. But fear not, as the key to unlocking that dream may lie in understanding the optimal time to make your move.

In the ever-evolving landscape of the Evergreen State’s real estate landscape, timing is everything. As mortgage rates fluctuate and inventory ebbs and flows, recognizing the best time to buy a home can empower you to negotiate better deals and secure the property of your dreams.

Imagine standing at the threshold of your first home, the excitement palpable as you survey the possibilities. But before you take that leap, it’s crucial to arm yourself with the insights that will give you a strategic advantage in this competitive market.

Unraveling the Washington Housing Market in 2024

Mortgage Rates and Affordability: Navigating the Challenge

The current mortgage rates in Washington hover around 7.03% as of August 2024, a slight decrease from the previous year. While these rates may still seem high compared to historical lows, they can have a significant impact on your monthly payments and overall budget.

For instance, on a $500,000 home with a 20% down payment, your monthly mortgage payment would be approximately $2,800 under the current rates. In contrast, during the 3.5% rates of early 2023, that same payment would have been around $1,900.

However, the good news is that 22.1% of homes in Washington are currently selling below their listing price. This presents an opportunity for savvy first-time buyers to potentially negotiate better deals and find more affordable homes.

Inventory and Demand: Navigating the Ebb and Flow

The Washington housing market is currently experiencing a surge in newly listed homes, with a 23.1% increase compared to the previous year. This means you, as a first-time buyer, have more options to choose from, potentially leading to less competition and more negotiating power.

Yet, even with this increased inventory, the median home price in Washington remains high at $613,900 as of August 2024. This price tag can still pose a significant challenge for those taking their first steps into homeownership.

Market Trends and Predictions: Navigating the Future

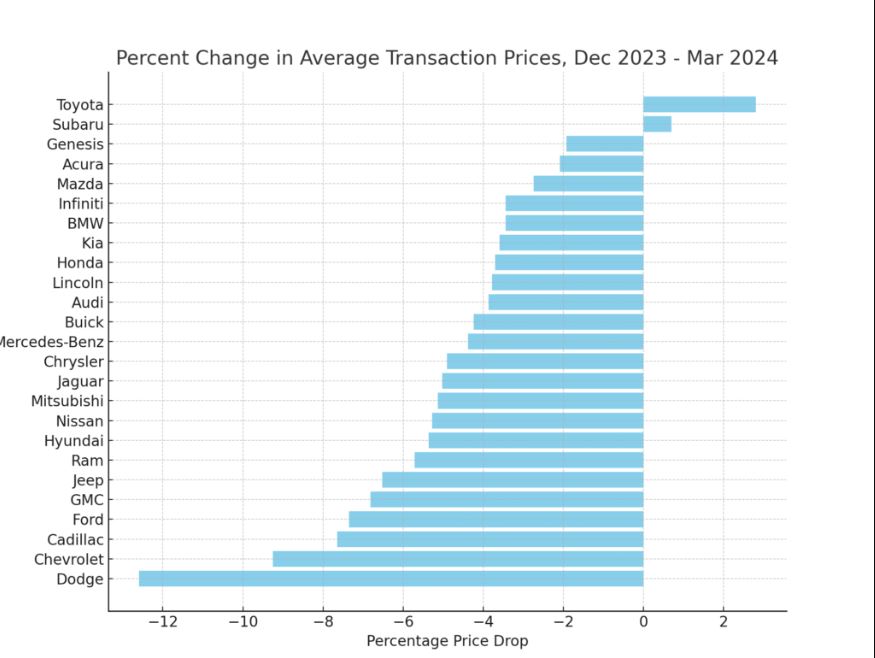

Experts predict that the Washington housing market will continue to see some price fluctuations throughout 2024, but overall, the trend is expected to remain strong. The recent decrease in mortgage rates and increased inventory could provide opportunities for first-time buyers to find their dream homes at more manageable prices.

According to Fannie Mae, mortgage rates may drop further in the second quarter of 2024 due to economic changes, inflation, and central bank policy adjustments. This could make it more affordable for first-time buyers to enter the market and achieve their homeownership goals.

Best Time to Buy Home: The Seasonal Strategies

Spring (March – May): Seizing the Surge

Spring is often considered the peak season for the Washington housing market, with higher buyer demand and increased competition. However, this period can also offer advantages for first-time buyers like yourself.

During these months, the inventory typically increases, and sellers may be more open to negotiations, as they strive to attract buyers before the summer rush. To succeed in this market, be prepared to move quickly, have your financing pre-approved, and be ready to negotiate.

The median home price in Washington during the spring months of 2024 is expected to be around $597,900, which could be more achievable for first-time buyers compared to the summer peak.

Summer (June – August): Navigating the Heat

The summer months in Washington tend to be the most active for the housing market, with a wider range of homes to choose from. However, this also means more competition from other buyers, potentially leading to higher prices and bidding wars.

As a first-time buyer, it’s essential to have your financing in order, work with a knowledgeable real estate agent, and be prepared to pay a premium for the right property. The median home price in Washington during the summer of 2024 is projected to reach $613,900, which may be more challenging for first-time buyers to afford.

Autumn (September – November): Seizing the Shift

As the weather cools and the holiday season approaches, the Washington housing market often sees a shift in dynamics. Sellers may be more motivated to sell before the winter, potentially leading to lower asking prices. However, the inventory may be more limited, and there could be fewer buyers in the market.

As a first-time buyer, be prepared to negotiate, have your financing ready, and be flexible with your timeline. The median home price in Washington during the autumn months of 2024 is expected to be around $605,100, which may be more attainable for first-time buyers compared to the summer peak.

Winter (December – February): Embracing the Chill

The winter months in Washington can present unique opportunities for first-time buyers like yourself. With lower demand and fewer buyers in the market, sellers may be more willing to negotiate on prices. However, the inventory may also be more limited, and there may be fewer open houses and showings to attend.

To take advantage of this season, have your financing pre-approved, be patient, and be prepared to move quickly if you find a good deal. Remember, the right timing can make all the difference in securing your dream home at a price that fits your budget.

Unlocking Your Path to Homeownership: Expert Tips for First-Time Buyers

Elevate Your Credit Score: The Key to Unlocking Favorable Rates

A good credit score is essential for securing a favorable mortgage rate in Washington. Take the time to improve your credit by paying bills on time, reducing debt, and avoiding new credit applications. Regularly check your credit report and address any issues to ensure you’re in the best position to take advantage of the market.

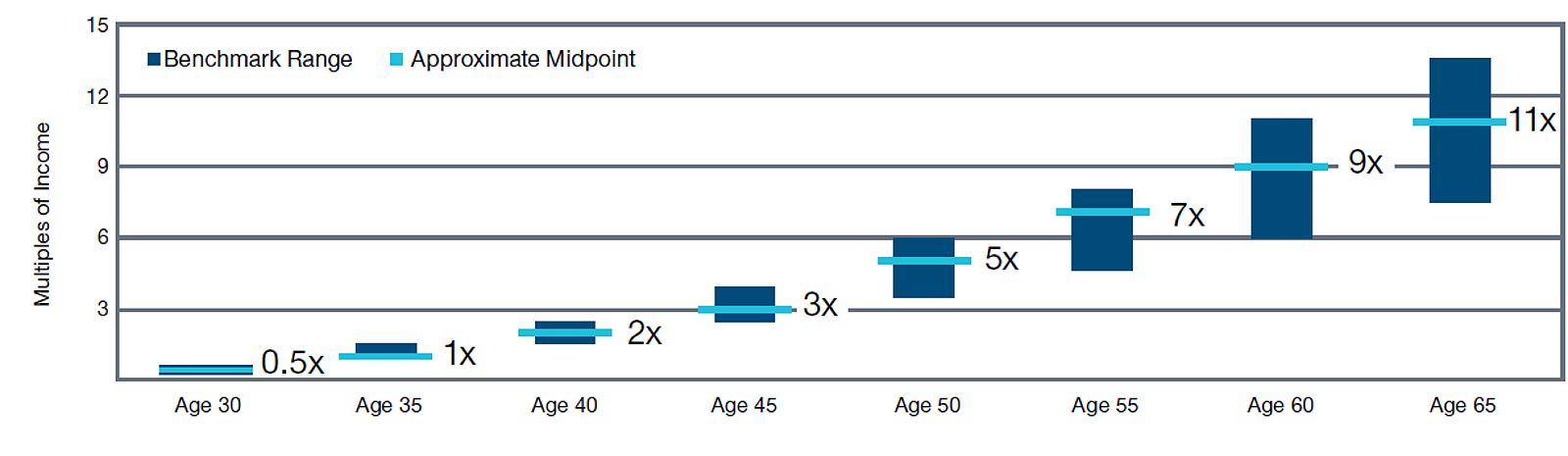

Strategize Your Down Payment: Maximizing Your Financial Advantage

Saving for a down payment can be a significant hurdle for first-time buyers. Aim to save at least 20% of the home’s value to avoid private mortgage insurance (PMI) and qualify for better loan terms. Explore down payment assistance programs and be diligent about budgeting and cutting expenses to grow your savings.

Get Pre-Approved: The Stamp of Confidence in a Competitive Market

Getting pre-approved for a mortgage before starting your home search can give you a significant advantage in the Washington housing market. This demonstrates to sellers that you are a serious and qualified buyer, which can help you stand out in a competitive market.

Partner with an Expert: Navigating the Washington Housing Landscape

Partnering with an experienced real estate agent in Washington can be invaluable for first-time buyers like yourself. They can help you navigate the local market, understand neighborhood dynamics, and guide you through the entire home-buying process, ensuring you make informed decisions.

Negotiate with Confidence: Securing the Best Possible Deal

Negotiating the price of a home is an essential step in the home-buying process. Research comparable properties, understand the current market conditions, and be prepared to walk away if the price is not right. Effective negotiation can help you secure a better deal on your dream home and maximize your investment.

FAQ

Q: What are the average closing costs in Washington?

The average closing costs in Washington range from 2% to 5% of the home’s purchase price, depending on various factors such as location, home value, and lender fees.

Q: How much should I budget for home repairs and maintenance?

As a general rule of thumb, it’s recommended to budget 1% to 3% of the home’s value annually for repairs and maintenance. This can help you prepare for unexpected expenses and ensure your home remains in good condition.

Q: What are some common first-time homebuyer programs in Washington?

Washington offers several programs to assist first-time buyers, including the Washington Housing Finance Commission’s Home Advantage program, which provides down payment assistance and competitive mortgage rates.

Q: What are some resources for finding affordable housing in Washington?

In addition to working with a real estate agent, first-time buyers in Washington can explore online resources like Zillow, Redfin, and Houzeo to search for homes within their budget.

Unlock Your Homeownership Dreams: A Strategic Approach for Washingtons First-Time Buyers

The journey to homeownership in Washington may seem daunting, but with the right strategy and a deeper understanding of the market, your dreams can become a reality. By recognizing the optimal timing, leveraging the available resources, and partnering with experienced professionals, you can position yourself for success in finding your perfect home.

Remember, the key lies in your ability to navigate the ebbs and flows of the Washington housing market. Stay informed, be proactive, and don’t be afraid to negotiate. With a strategic mindset and a touch of determination, you can unlock the door to your Washington dream home.

This text was generated using a large language model, and select text has been reviewed and moderated for purposes such as readability.

MORE FROM searchsmartdeals.com